Employment remains weak, but a recovery is in the cards

Raymond James Chief Economist Eugenio J. Alemán discusses current economic conditions.

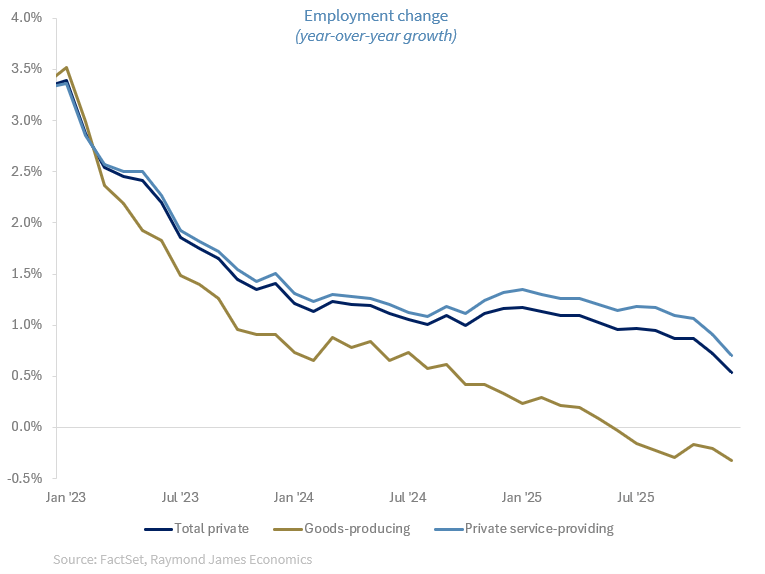

The biggest concern for the Federal Reserve (Fed) today is the weakness in employment over the last year, and especially during the second half of the year. This weakness was behind its decision to resume interest rate cuts in September of 2025. Although the weakness in job growth was evident in the goods-producing sector of the economy for a long time, the weakness in employment in the services side of the economy became apparent during the second half of the year, as can be seen in the graph below.

However, there have been recent signs that employment in the services side of the economy is starting to improve. The first expansionary month came in December 2025, with the ISM Services PMI Employment index crossing into expansion territory after several months showing contractionary levels of employment but with incremental improvements since July of 2025. The December reading on the ISM Services Employment index was 52%, the first reading above 50% since a reading of 50.7% in May of 2025.

The biggest problem is that the recent improvement in employment in the services sector remains limited to a few industries, as exemplified by the December 2025 nonfarm payroll report. The report showed basically two sectors increasing employment, the health care and social assistance and leisure and hospitality sectors, adding 38,500 and 47,000 new jobs, respectively during the month.

The increase in jobs from the health care and social assistance sector was expected, as it is a sector that is relatively recession proof while the increase in the leisure and hospitality sector was more of a surprise, especially because it was very strong. But the biggest issue for the Fed is that employment growth in the cyclical sectors of employment, that is, those that follow the ups and downs of the business cycle, are growing at slightly negative rates as of December of last year, as the graph below shows, while health care and social assistance employment is growing but has also slowed down considerably during 2025.

Federal Reserve: Between a rock and a hard place

Now, the question for the Fed is: What to do? Tariffs were, presumably, designed to bring back manufacturing jobs to the US, but that has not happened and, in fact, manufacturing employment has continued to come down since the tariffs were imposed. Some of the explanations for this are that higher imported input costs have meant that manufacturing production has become even less competitive than before in the global economy, and manufacturers have reduced production and thus employment in the sector.

Another potential explanation is that the One Big Beautiful Bill Act (OBBBA) has created important incentives for firms to invest in capital rather than in labor, since capital and employment are competitive (i.e., substitutes) factors in the production process. In fact, according to the Tax Foundation, the manufacturing sector will benefit the most from the OBBBA during the next ten years, to the tune of $423 billion during the 2025-2035 period, with the information industry coming in second with a benefit of $136 billion.*

Thus, why would any one of these industries choose to hire workers when they can invest in capital and at the same time reduce their tax liabilities? In today’s world, the emergence of AI at a time when the supply of labor has been reduced by aging and other policies, i.e., immigration, is adding to the substitution away from labor. If, on top of this, you sprinkle capital investment with full capital expensing, then, as our children would say, it is ‘a no-brainer.’

So, you would probably ask, what does this have to do with Fed policy? The answer is that it has nothing to do with Fed policy. Interest rates cannot undo what these factors are doing. Growth in the labor force is slowing down because of population dynamics (a structural issue) and government policies, i.e., reduced immigration, none of which monetary policy has any influence over, while capital expensing is also a policy decision over which the Fed has no influence. Furthermore, lower interest rates could actually accelerate this process of substitution away from labor and into capital in the production process, aggravating the issues for the US labor market, especially in those sectors most benefited by the OBBBA.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those of Raymond James and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Past performance may not be indicative of future results.